Client

Amanj Academy

Services

Visual Design UI & UX Design Product Design

Industries

Finance

Date

June 2021

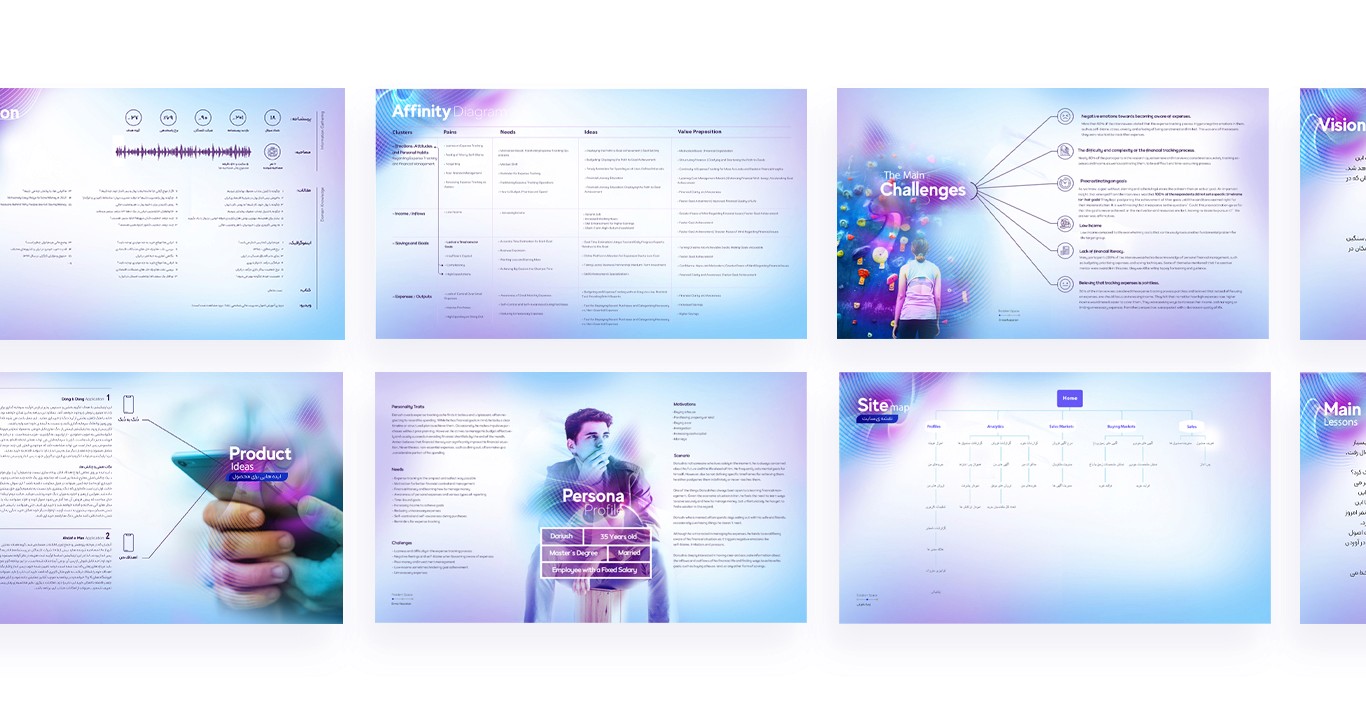

Problem Statement: With worsening economic conditions in Iran, individuals earning between 5 to 10 million tomans (approximately $120 to $240) face significant barriers in achieving financial goals such as purchasing a car or home. The challenge was to develop an application that not only assists users in saving but also educates them on financial management. Research Methodology: To gain a deeper understanding of user needs, the following research methods were employed: Literature Review: Analyzed 15 articles, 17 infographics, and several podcasts on financial management and the Iranian economy. Surveys and Interviews: Conducted an online survey with 201 participants, with 90 completing the survey, leading to the identification of 27 target users. Additionally, six in-depth interviews were conducted to gather qualitative insights into financial behaviors and challenges. Key Findings: Users struggle with understanding financial management and investment habits. There is a demand for a platform that not only provides financial services but also educates users comprehensively. User Personas: Based on research findings, two primary personas were developed: Economic Saver: Seeks a safe and low-risk saving strategy. Learning Investor: Interested in learning about investment but finds financial terminology complex.

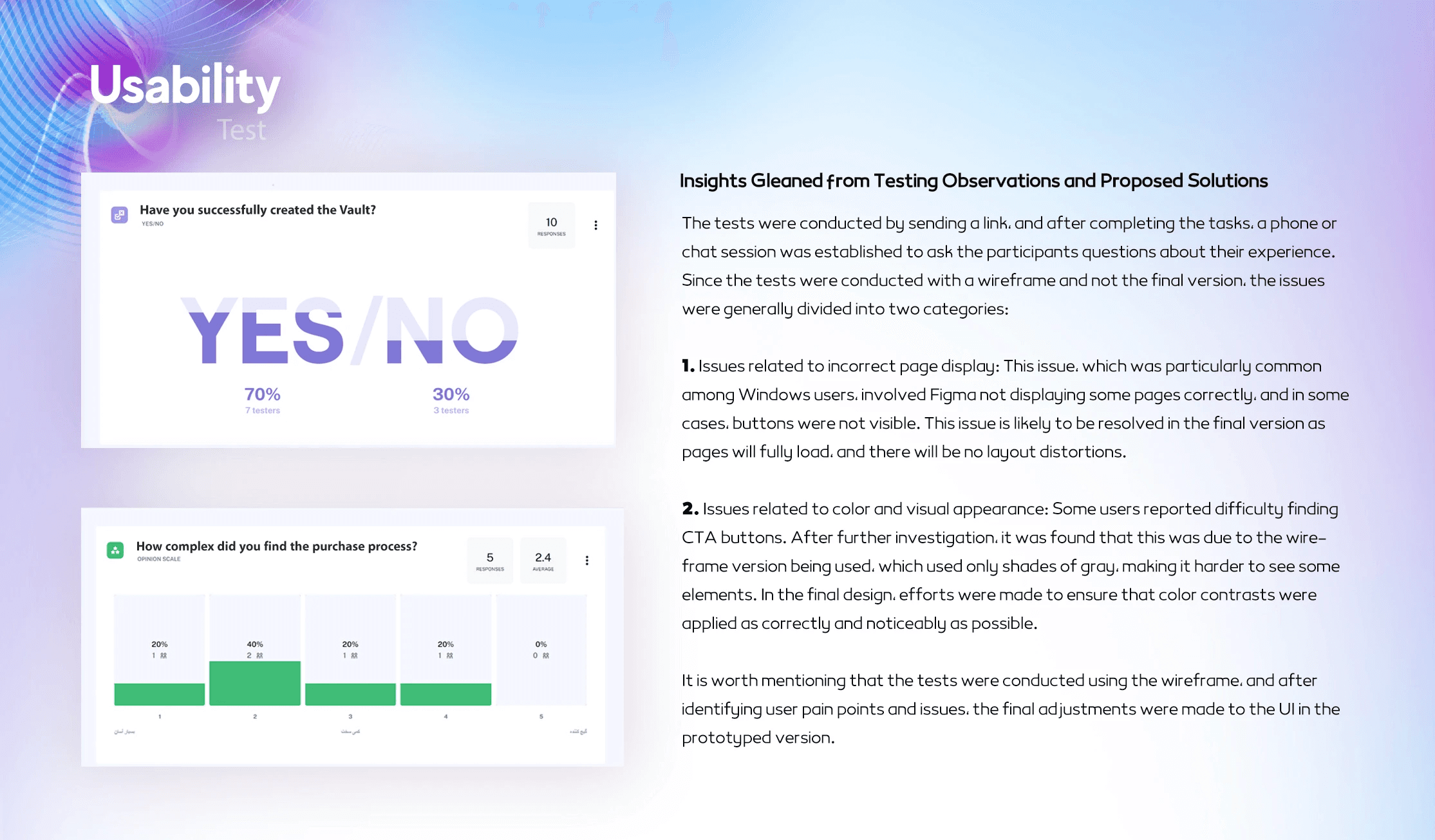

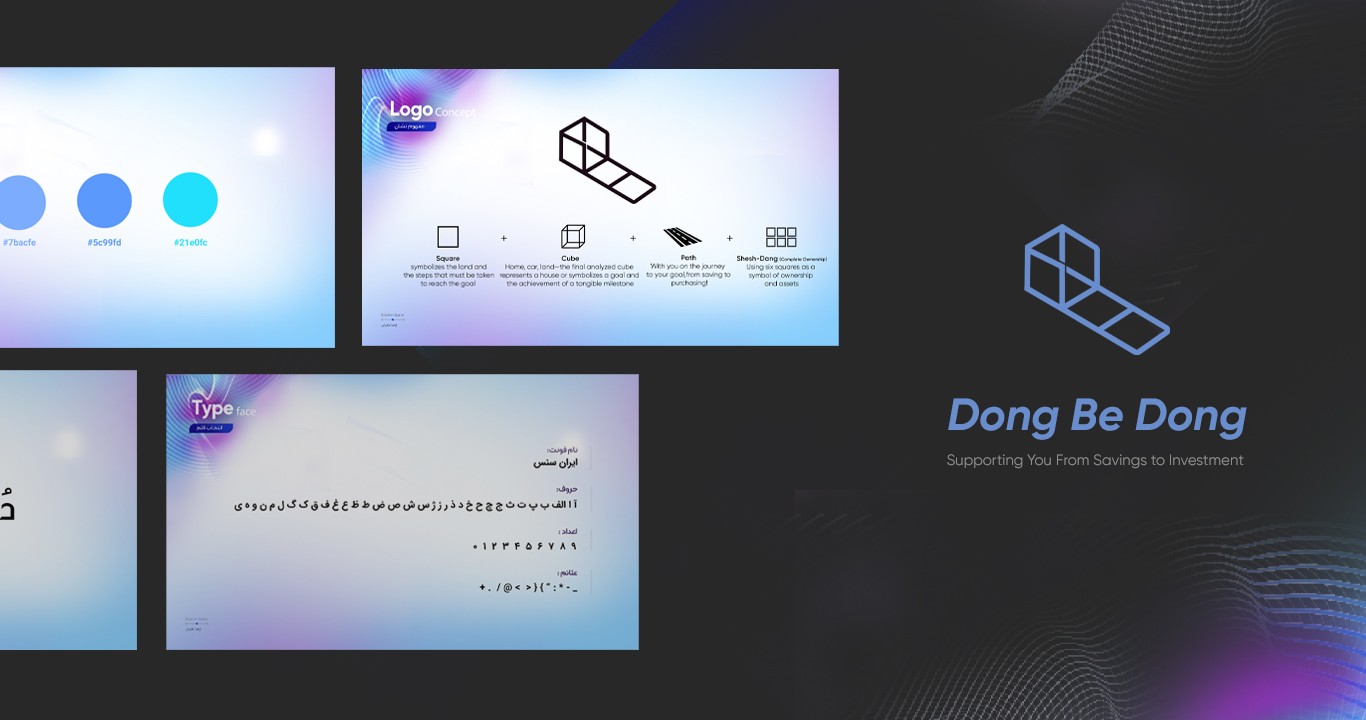

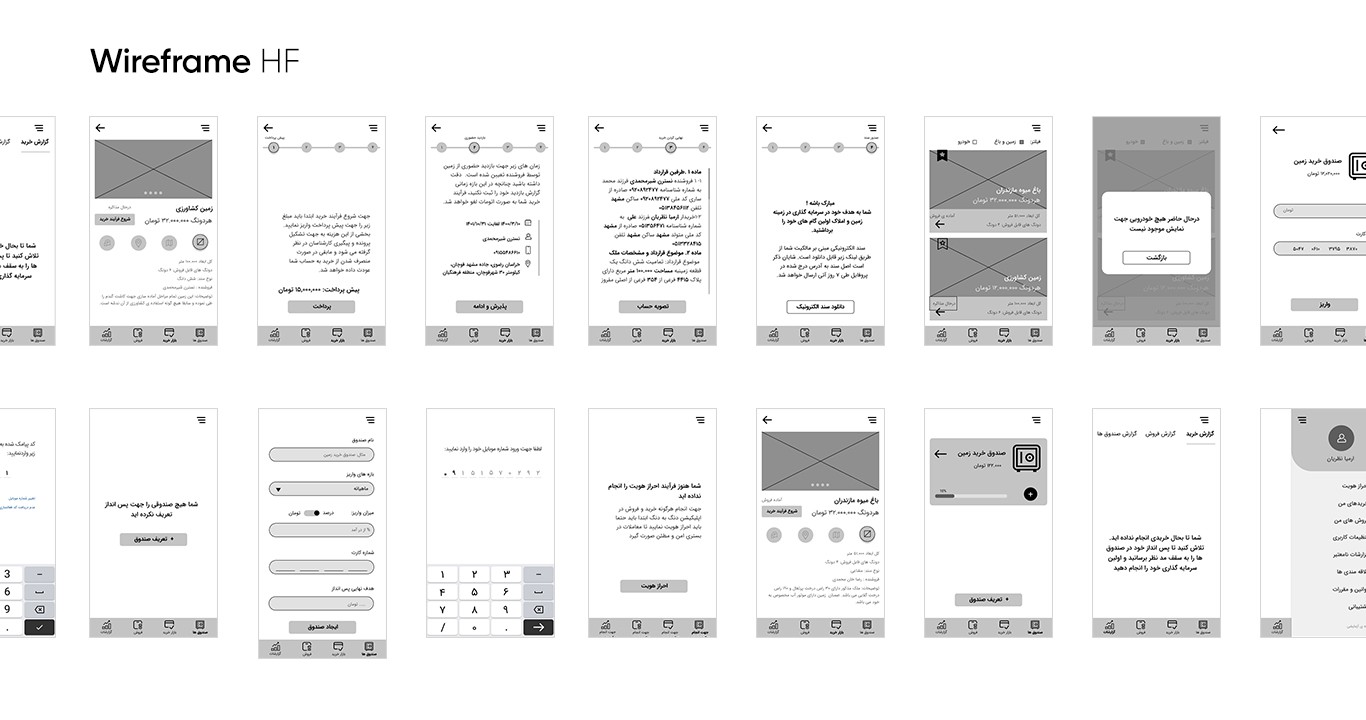

Design Process 1. Wireframing Low-fidelity prototypes were created to visualize layouts and user flows. 2. Prototype Testing High-fidelity prototypes were developed in Figma and tested with real users. Usability Testing Results: 70% of users had difficulty locating key action buttons, indicating a need for design improvements. Final Design Features Onboarding Process: A secure sign-up process incorporating identity verification to ensure transaction safety. User-Friendly Interface: A well-structured UI designed for easy navigation and comprehension of complex financial information. Outcomes and Impact Usability testing revealed actionable insights that significantly enhanced the user interface, focusing on accessibility and ease of use. Design modifications reduced user confusion and increased task completion rates. Conclusion The DongBeDong platform was developed with a user-centric approach, aiming to improve financial literacy and accessibility for individuals in Iran. Continuous user feedback and iterative improvements are crucial for the product's success. Next Steps and Key Learnings Next Steps: Ongoing User Research: Continue conducting usability tests and collecting feedback to refine features and optimize the user experience. Feature Enhancements: Explore additional features such as personalized financial recommendations to help users make better financial decisions. Community Engagement: Develop social features to foster a sense of community where users can share financial tips and experiences. Localization Improvements: Adapt the platform further to align with evolving economic conditions and specific user needs in Iran. Key Learnings: User Education is Essential: Many users lacked foundational financial knowledge, highlighting the need for an integrated educational component. Simplicity Improves Adoption: Reducing cognitive load through intuitive design significantly improves engagement and usability. Trust is a Major Factor: Users expressed concerns about security and transparency, emphasizing the importance of clear communication and trust-building mechanisms. By integrating these learnings into future developments, the DongBeDong platform can continue to evolve and better serve its users. Note: This project was created as part of a course at Amanj Academy, one of the country's top training institutes. It was recognized as the best project of the program, and I received the highest score as the top student.